불만 | Advancements In IRA Gold Custodians: A Complete Overview

페이지 정보

작성자 Jasmine 작성일25-08-11 10:03 조회48회 댓글0건본문

In recent times, the panorama of retirement savings has developed significantly, significantly with the rising interest in treasured metals as a hedge in opposition to market volatility and inflation. Among these, gold has emerged as a popular selection for buyers looking to diversify their Individual Retirement Accounts (IRAs). This text explores the demonstrable advances in IRA gold custodians, specializing in the providers they provide, regulatory changes, technological innovations, and the general affect on traders.

Understanding IRA Gold Custodians

An IRA gold custodian is a financial institution that holds and safeguards the physical gold and different valuable metals inside an individual’s IRA. These custodians are liable for ensuring that the investments comply with IRS rules, offering a secure storage answer, and facilitating transactions. The role of custodians has become more and more essential as extra buyers search to incorporate gold of their retirement portfolios.

Regulatory Adjustments

Considered one of the numerous advances within the realm of IRA gold custodians has been the evolution of regulatory frameworks governing precious metals investments. The IRS has established particular guidelines concerning the sorts of gold and different metals that may be included in a self-directed IRA. These rules have turn out to be clearer and more stringent, making certain that investors are fully knowledgeable about their choices and obligations.

For example, the IRS stipulates that only certain sorts of gold bullion and coins are eligible for IRA investment. This includes gold that meets a minimum fineness of .995, akin to American Gold Eagles, Canadian Gold Maple Leafs, and certain gold bars. Custodians have tailored to those laws by offering comprehensive academic sources and steering to buyers, ensuring compliance and minimizing the risk of penalties.

Enhanced Security Measures

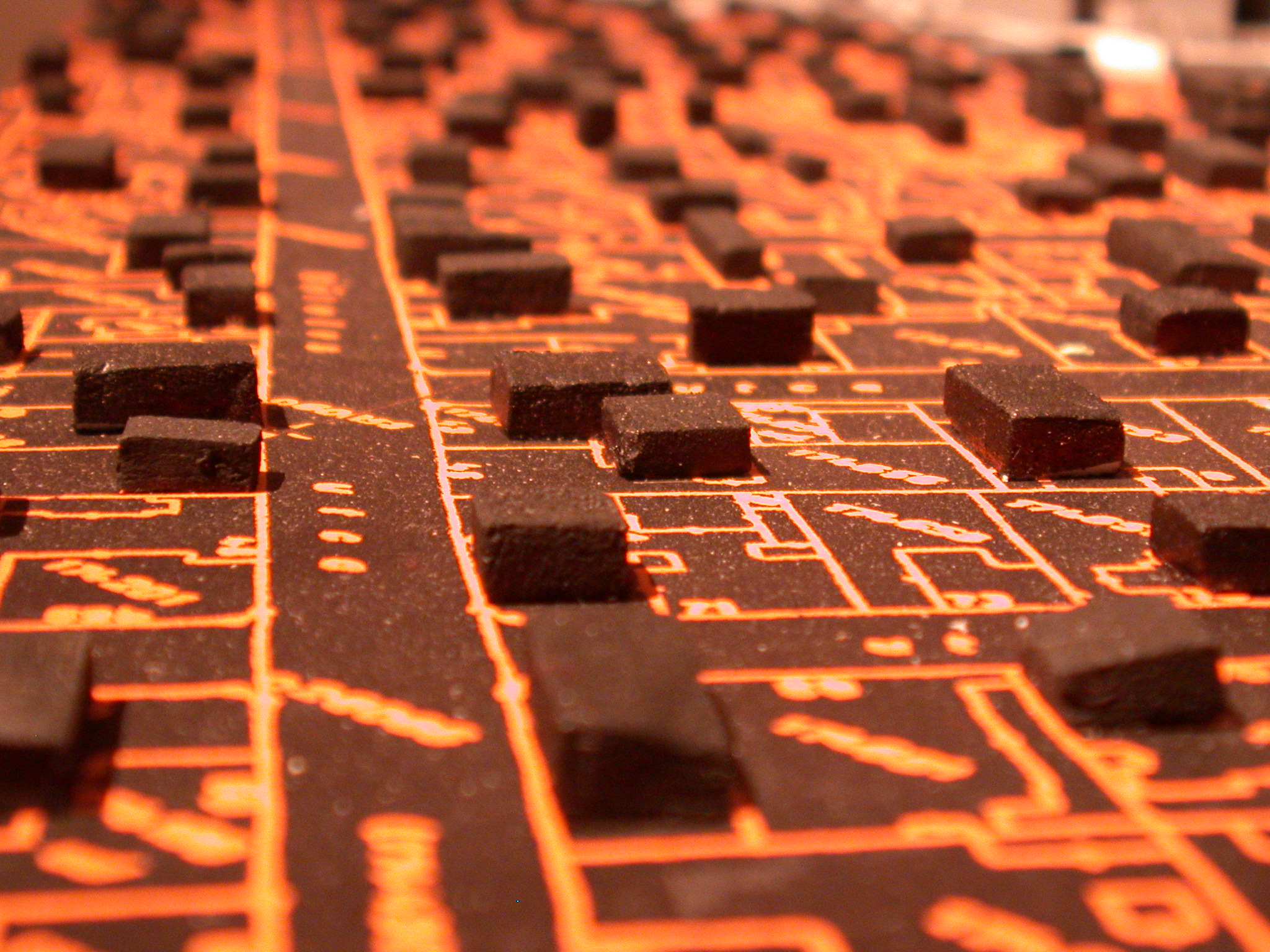

As the demand for gold IRAs has surged, so too have the safety measures employed by custodians. Advances in expertise have led to improved safety protocols, together with state-of-the-art vaulting systems and insurance coverage protection for precious metals. Many custodians now accomplice with reputable storage amenities that provide high levels of security, together with 24/7 surveillance, biometric entry controls, and insurance against theft or injury.

Additionally, custodians have implemented superior digital safety measures to guard purchasers' accounts and personal information. Two-issue authentication, encryption technologies, and secure online platforms have become customary practices, making certain that traders can manage their gold IRAs safely and conveniently.

Technological Innovations

The rise of fintech has significantly impacted the way IRA gold custodians operate. Many custodians have embraced know-how to streamline processes, improve customer support, and enhance the general user experience. For example, online platforms now enable buyers to open accounts, buy gold, and manage their portfolios from the comfort of their homes.

Some custodians have developed mobile functions that provide real-time updates on gold prices, account balances, and transaction history. These functions usually embrace academic resources, market evaluation, and investment tips, empowering buyers to make knowledgeable choices.

Moreover, blockchain technology is beginning to play a job within the precious metals business. Whereas nonetheless in its infancy, blockchain presents the potential for higher transparency and traceability in gold transactions. Some custodians are exploring the usage of blockchain to verify the authenticity of gold merchandise and observe their motion, thereby enhancing belief out there.

Improved Customer service

As competition amongst IRA gold custodians has intensified, many have made vital strides in bettering customer service. Enhanced communication channels, personalised help, and educational resources at the moment are more readily accessible to traders. Custodians are more and more offering dedicated account representatives who can guide shoppers by the intricacies of investing in gold IRAs.

Moreover, many custodians have invested in complete educational supplies, including webinars, articles, and FAQs, to help traders perceive the benefits and dangers associated with gold investments. This emphasis on education not only enhances customer satisfaction but also promotes knowledgeable resolution-making.

Diversification Choices

One other notable development in the choices of IRA gold custodians is the enlargement of diversification choices. Whereas gold remains the first focus, many custodians now present entry to a broader range of valuable metals, including silver, platinum, and palladium. This diversification permits investors to unfold their threat and IRA gold custodian capitalize on the unique market dynamics of different metals.

Moreover, some custodians have begun to supply alternative investment alternatives inside the realm of treasured metals, similar to mining stocks and change-traded funds (ETFs) that monitor the efficiency of gold and different commodities. This diversification can enhance the potential for returns whereas still offering the safety and stability associated with bodily precious metals.

Aggressive Price Buildings

As the market for gold IRAs has grown, IRA gold custodian custodians have become more and more aggressive in their price constructions. Many custodians now supply transparent pricing models with no hidden fees, making it simpler for buyers to grasp the prices associated with their accounts. Some custodians have even launched tiered pricing based mostly on account measurement, permitting traders to benefit from decrease charges as their investments grow.

Moreover, promotional presents, similar to waived setup fees or decreased annual fees for the first 12 months, have grow to be extra common. These aggressive pricing strategies not only appeal to new investors but additionally encourage present shoppers to develop their portfolios.

Conclusion

The developments in IRA gold custodians reflect a dynamic and evolving landscape that prioritizes security, compliance, and customer satisfaction. As traders more and more recognize the worth of gold as a hedge towards financial uncertainty, custodians are adapting to meet their wants by means of regulatory readability, enhanced security measures, technological improvements, improved customer support, diversification choices, and competitive price structures.

These developments not only facilitate a smoother funding experience but in addition empower traders to make informed decisions about their retirement savings. As the demand for gold IRAs continues to develop, it is likely that custodians will keep innovating to offer the absolute best companies and options for their purchasers, guaranteeing that the future of gold investing stays brilliant and promising.

댓글목록

등록된 댓글이 없습니다.