불만 | Understanding Unsecured Personal Loans For Bad Credit: Month-to-month …

페이지 정보

작성자 Kathlene 작성일25-07-14 04:56 조회15회 댓글0건본문

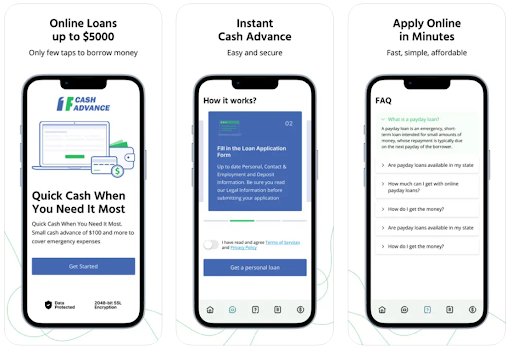

In at present's monetary landscape, $3000 personal loan bad Credit unsecured personal loans have change into an more and $3000 personal loan bad credit more standard option for people in search of fast entry to money. However, for these with unhealthy credit, the method can be fraught with challenges. This article explores the dynamics of unsecured personal loans for individuals with poor credit score histories, specializing in monthly funds, interest rates, and related dangers.

Defining Unsecured Personal Loans

Unsecured personal loans are loans that are not backed by collateral. In contrast to secured loans, the place the lender can declare an asset (like a automobile or residence) if the borrower defaults, unsecured loans rely solely on the borrower’s creditworthiness. This makes them inherently riskier for lenders, especially when the borrower has a bad credit score score, sometimes defined as a rating beneath 580 on the FICO scale.

The Panorama of Bad Credit score

Unhealthy credit can stem from varied factors, including late payments, high credit utilization, bankruptcies, and extra. Individuals with bad credit typically discover themselves in a tough financial state of affairs, where conventional lending choices are restricted. This could make them seek out unsecured personal loans as a method to consolidate debt, cover emergency expenses, or finance private projects.

Monthly Payments: What to Anticipate

One of many most crucial facets of any loan is knowing the monthly fee obligations. For unsecured personal loans, monthly funds are decided by a number of factors:

- Loan Quantity: The full quantity borrowed will directly influence the month-to-month fee. Bigger loans will typically end in greater month-to-month payments.

- Interest Fee: Borrowers with bad credit can count on to pay greater curiosity charges in comparison with those with good credit score. Interest charges for unsecured personal loans for bad credit can range from 10% to over 30%, relying on the lender and the borrower's credit score profile.

- Loan Term: The size of the loan term additionally affects month-to-month payments. Should you have just about any inquiries with regards to in which and also tips on how to make use of $3000 personal Loan bad credit, $3000 personal loan bad credit you'll be able to e-mail us in the web-page. Shorter loan terms normally mean greater month-to-month funds but less interest paid over the life of the loan. Conversely, longer phrases can decrease monthly payments but enhance the entire curiosity paid.

Calculating Monthly Funds

To illustrate how these factors come into play, consider a borrower with dangerous credit score who takes out a $10,0elp enhance a credit score rating, missed payments can additional harm an already poor $3000 personal loan bad credit credit score historical past.

Alternatives to Unsecured Personal Loans

For these with unhealthy credit score, it is essential to consider options to unsecured personal loans. Some choices embrace:

- Credit score Unions: Many credit score unions supply personal loans with more favorable phrases for members, together with these with bad credit.

- Peer-to-Peer Lending: Platforms like LendingClub or Prosper connect borrowers with individual traders, typically offering more flexible phrases than conventional lenders.

- Secured Loans: If a borrower has an asset they will use as collateral, a secured loan may supply lower curiosity charges and better terms.

- Credit Counseling: In search of assistance from a credit score counseling service will help people develop a plan to manage their debts and improve their credit score over time.

Conclusion

Unsecured personal loans generally is a viable option for individuals with dangerous credit score looking for fast monetary relief. However, the related monthly payments could be burdensome, especially given the upper interest charges and potential for long-term debt. It is crucial for borrowers to completely perceive their financial situation and explore all out there choices earlier than committing to a loan. By doing so, they can make knowledgeable decisions that align with their monetary targets and keep away from falling right into a cycle of debt. Because the landscape of private finance continues to evolve, staying knowledgeable and proactive is key to achieving monetary stability.

댓글목록

등록된 댓글이 없습니다.